Aleppo Terus Menangis: Dilema Krisis di Syria

Zulkifli Hasan

Pendahuluan

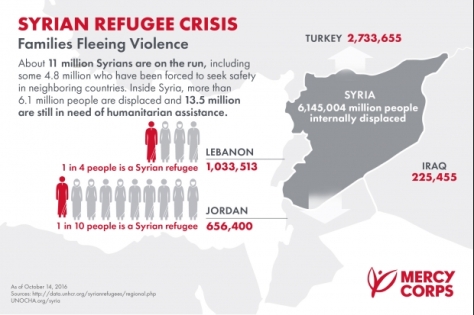

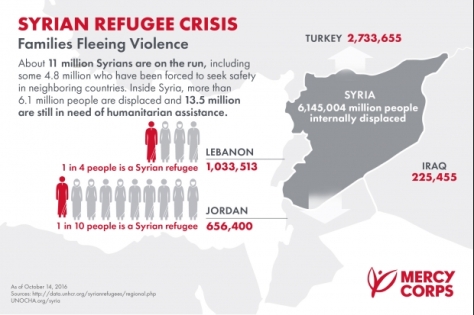

Krisis yang berlaku di dunia Islam khususnya di Timur Tengah seperti di Syria, Mesir, Libya, Iraq, dan Palestine termasuk di Arakan, Myanmar dan Xinjiang China begitu menyedihkan umat Islam dan masyarakat dunia umumnya. Khususnya di Syria dengan berita terkini kekejaman rejim Asad memusnahkan Aleppo meratah rakyat sendiri, krisis politik dan kemanusiaan berterusan seumpama tiada garisan penamat. Rejim Asad terus mengganas dengan sokongan beberapa kuasa besar membunuh sewenang-wenangnya tanpa ada perasaan belas kasihan dan kemanusiaan. Ironinya, ada segelintir agamawan ‘kerajaan’ yang berdiam diri menolak untuk mengutuk rejim Asad dengan pelbagai alasan dan justifikasi. Malangnya yang menjadi mangsa utama adalah rakyat awam terutama kanak-kanak, wanita, warga emas serta orang kurang upaya. Kekalutan dan kemuncak kesengsaraan kini berlaku di Syria sebenarnya adalah manifestasi kegagalan umat Islam seluruhnya.

Pelbagai liputan media massa yang memaparkan situasi di Syria juga menimbulkan kekeliruan. Robert Fisk yang terkenal sebagai rujukan utama isu politik dan perkembangan di Timur Tengah juga menunjukkan sikap dan kecenderungan yang membingungkan ramai pihak. Bagi memahami krisis di Syria ini, penulis mengambil pendekatan seimbang sebagai asas membolehkan kita memahami krisis di Syria dan memastikan sebarang reaksi, persepsi dan tindakbalas adalah berhikmah.

Berbanding dengan siri kebangkitan rakyat di Tunisia dan Mesir, krisis di Syria mendapat liputan dan analisis yang agak berbeza daripada pelbagai pihak. Secara umumnya, terdapat dua teori yang berkaitan dengan krisis di Syria. Golongan pertama berpandangan bahawa jatuhnya rejim Bashar Al-Assad akan mengukuhkan pengaruh Israel di Timur Tengah. Golongan kedua pula mempunyai teori dan pandangan yang berlainan di mana krisis di Syria dianggap sebagai sesuatu yang ’genuine’ dan penentangan terhadap rejim Bashar al Assad adalah suatu tuntutan jihad. ’Dichotomy’ dan dua teori yang bertentangan ini telah menimbulkan kesulitan kepada aktivis dan badan bukan kerajaan yang sedang memperjuangkan nasib dan kehidupan rakyat Syria yang kini menghadapi krisis kemanusiaan yang sangat membimbangkan. Hingga kini dilaporkan bilangan penduduk yang terkesan dan menghadapi krisis kemanusiaan akan mencecah 20 juta.

Perkembangan yang berlaku di Iraq juga memberikan satu dimensi baru kepada situasi di Timur Tengah. Sekumpulan pejuang yang dikenali sebagai Islamic State of Iraq and levant (ISIL) juga telah mengisytiharkan pembentukan khilafah apabila berjaya menguasai sebahagian besar kawasan di Iraq dengan menjadikan Abu Bakar al Baghdadi sebagai khalifah abad 21. Kini terdapat beberapa kumpulan yang sedang berjuang dan berjihad menentang kezaliman dan kekufuran seperti yang diketahui dan ini termasuk ISIL, Free Syrian Army (FSA) dan sebagainya. Situasi ini semakin menimbulkan kekeliruan di kalangan umat Islam malahan masyarakat umum di seluruh dunia. Oleh itu, pemerhatian secara menyeluruh dan berhati-hati perlu diberikan bagi memahami dan meneliti perkembangan terkini apa yang berlaku di Syria. Asasnya, umat Islam perlu melihat dari aspek taklif atau tanggungjawab membantu rakyat Syria yang kini melalui saat kehidupan yang begitu dhaif, mencabar dan memeritkan dengan serba kekurangan khususnya dari aspek kemanusiaan seperti tempat tinggal, keperluan asas, ubat-ubatan, pendidikan dan juga hak untuk diberikan perhatian dari sudut hak kemanusiaan.

Krisis di Syria dan Persoalan

Pandangan yang menganggap rejim Bashar al Assad sebagai pengancam Israel dan kejatuhannya hanya akan mengukuhkan hegemoni Israel di Timur Tengah ini disuarakan oleh ramai penganalisis politik dan jurnalis antarabangsa seperti Robert Fisk termasuk tokoh ulama iaitu Sheikh Imran Hossein. Robert Fisk di dalam artikelnya bertajuk ”Bashar al Assad, Syria, and The Truth About Chemical Weapons” menyuarakan pandangannya mengenai usaha Amerika memburukkan rejim Bashar al Assad dengan hasrat untuk menjatuhkannya melalui tuduhan menggunakan senjata kimia. Ini disokong oleh Professor Michel Chossudovsky di dalam artikel beliau ”Confronting Iran, Protecting Israel: The Real Reason for America’s War on Syria”. Beliau berpandangan bahawa kejatuhan rejim al Assad hanya akan mengakibatkan Syria dapat dikuasai oleh sekutu atau agen Amerika dan Israel dan dengan itu, Hamas dan Hezbollah dapat dihapuskan sekali gus melemahkan Iran yang dianggap musuh dan ancaman kepada mereka. Terdapat juga segelintir ahli akademik tanahair yang cenderung dengan pandangan ini malahan melabelkan pejuang pembebasan Syria ini dengan gelaran ”pemberontak” dan ”pengganas” yang sama sekali bertentangan dengan mauqif ulama muktabar.

Berdasarkan permasalahan di atas, penulis ingin berkongsi pandangan mengenai krisis yang berlaku di Syria dan cuba merungkaikan beberapa persoalan yang kini membelenggu pemikiran sesetengah pihak. Penulis telah merujuk pelbagai sumber makalah, artikel, buku, berita, laporan, jurnal dan sebagainya termasuk menghadiri syarahan ulama tersohor Syria, maklumat sumber pertama sahabat-sahabat di Syria serta penerangan oleh aktivis-aktivis yang telah masuk ke Syria termasuk buku tulisan Dr. Zulkifli Al Bakri bertajuk ’Krisis Syria dan Mauqif Ulama’ yang menjelaskan pendirian dan pandangan ulama muktabar mengenai krisis di Syria. Berdasarkan sumber-sumber sahih ini, penulis sangat berkeyakinan bahawa krisis di Syria ini adalah sesuatu yang ’genuine’ dan umat Islam bertanggungjawab untuk memberikan bantuan kemanusiaan kepada warga Syria yang memerlukan. Rakyat Syria yang berjihad menentang kezaliman dan kemungkaran diketuai rejim Bashar al Assad ini bukanlah ’pemberontak’ tetapi adalah pejuang pembebasan dan jika gugur dikategorikan sebagai syahid. Bersama-sama dengan rakyat Syria bangun menentang kezaliman, keganasan, ketidakperikemanusiaan dan ketidakadilan adalah suatu tuntutan dan kewajipan umat Islam.

Merungkai Persoalan Krisis di Syria dan Mauqif Ulama

Bagi memahami krisis di Syria ini, perlu juga dilihat terlebih dahulu Syria dari sudut demografi. Syria mendapat kemerdekaan pada 1946 dengan penduduk berjumlah lebih 23 juta. 75% adalah Muslim-sunni tetapi kerajaan Syria dikuasai oleh parti Baath iaitu diwakili minoriti Alawi yang hanya 3-4%. Parti Baath yang minoriti Alawi ini bermazhab Syiah Nusairiah dan berideologi sosialis. Berdasarkan demografi ini, amatlah bermanfaat untuk menelusuri serba sedikit asal usul rejim al Assad di Syria ini. Setelah kemerdekaan Syria telah dipimpin oleh keluarga al Assad. Kemuncak kezaliman rejim al Assad ini telah berlaku pada 1982 di bawah pimpinan Hafiz al Assad (memerintah selama 32 tahun) sewaktu tragedi berdarah di bandar Hamah yang meragut nyawa lebih 40 ribu penduduk, 15 ribu hilang tempat tinggal dan 150 ribu menjadi mangsa pelarian. Bukan itu sahaja, dilaporkan lebih 88 buah masjid dimusnahkan dan infrastruktur awam dihancurkan. Sebegitu ramai ulama dan ilmuan Islam yang dipenjara, diseksa dan dibunuh. Di antara ulama yang menjadi pelarian politik ialah Sheikh Abu Fattah Abdu Ghuddah, Sheikh Said Hawa, Sheikh Muhammad Ali Al Sabuni, Sheikh Muhammad Hashim al Majzub, Sheikh Usamah al Rafie dan ramai lagi.

Bashar al Asad telah mengambil alih pemerintahan daripada Hafiz al Assad pada tahun 2000 setelah Perlembagaan Negara dipinda semata-mata untuk membolehkannya menjadi Presiden yang pada itu belum mencapai umur 40 tahun yang dibenarkan. Beliau meneruskan kekejaman lalu dengan beberapa insiden kemanusiaan seperti peristiwa berdarah Qamisyli pada 2004 dan 2008, peristiwa Hasakah pada 2004 dan peristiwa penjara Soydana. Tragedi 2011 hingga hari ini adalah yang paling trajis di mana telah meragut nyawa ratusan ribu rakyat Syria yang majoritinya adalah Muslim-sunni. Ini disahkan oleh Utusan Khas PBB dan Liga Arab, Lakhdar Brahimi. Malahan kekejaman rejim Bashar al Assad juga telah meranapkan pelbagai kesan sejarah penting Islam seperti Maktabah al Khanji yang dianggap antara perpustakaan tertua dunia yang mempunyai koleksi berharga yang tidak ternilai. Melalui fakta-fakta ini, sudah jelas lagi bersuluh betapa tidak logiknya sebarang pandangan yang menyokong rejim Bashar al Assad atas apa sahaja alasan. Malahan melabelkan rakyat yang menuntut keadilan dengan gelaran pemberontak atau pengganas adalah suatu perkara yang amat dikesalkan.

Selain itu, adalah amat penting juga untuk mengenali Alawi atau Shiah Nusairiah yang pengikutnya menguasai kerajaan Syria. Shiah Nusairiah di Syria ini mempunyai hubungan amat rapat dengan Iran dan Hizbullah. Ini kerana terdapat segelintir umat Islam termasuk di Malaysia yang tidak mempunyai gambaran sebenar malahan memberikan sokongan kepada rejim Bashar al Assad dan menganggap Iran serta Hizbullah sebagai pembela agama dan memberi ancaman kepada Israel. Dilaporkan juga Iran telah membekalkan pelbagai jenis senjata kepada Syria. Ayatullah Ali Khomeini pernah mengeluarkan fatwa bahawa wajib rakyat Iran mempertahankan rejim al Assad. Dalam hal ini, kita perlu merujuk kepada pandangan dan fakta-fakta mengenai shiah Nusairiah ini. Sebenarnya, terlalu ramai ulama muktabar telah terlebih awal memberikan fatwa mengenai kesesatan Syiah Nusairiah. Ibn Taimiyah, Ibnu Kathir, al Zahabi, Sheikh Abdul Aziz Baz dan Sheikh Ali al Sabuni secara jelas memfatwakan shiah nusairiah sebagai sesat. Sheikh Gharib al Sirjani mengatakan bahawa kesesatan shiah Nusairiah ini adalah berasaskan ijma. Oleh itu, sebarang pandangan yang menyokong rejim Bashar al Assad yang juga shiah Nusairiah ini adalah dianggap perkara mungkar dan menyesatkan.

Bagi mengukuhkan pandangan betapa rejim Bashar al Assad ini perlu ditentang dan dijatuhkan, penulis ingin merujuk kepada beberapa pendirian ulama muktabar kontemporari seperti yang dinukilkan di dalam buku ’Krisis Syria dan Mauqif Ulama”. Sheikh Abdul Aziz Baz pada 1982 berfatwa bahawa wajib memberi bantuan kepada umat Islam yang dizalimi oleh rejim Al Assad. Sheikh Yusuf al Qaradhawi dengan tegas menyatakan bahawa wajib bagi rakyat Syria untuk bangkit menentang rejim al Assad malahan menggesa jemaah haji berdoa untuk kehancurannya. Sheikh Ali al sabuni yang pernah berada di Malaysia dengan tegas menggesa umat Islam untuk memberikan bantuan sewajarnya bagi meringankan kesengsaraan rakyat Syria. Ramai lagi ulama tersohor seperti Sheikh Soleh al Luhaidan, Sheikh Muhammad Hasan, Sheikh Aidh al Qarni, Sheikh Muhammad al Irifi, Sheikh Ahmad Qattan dan Sheikh Wahbah al Zuhaili memberikan pandangan yang sama di mana menyeru umat Islam untuk membantu rakyat Syria.

Pandangan dan pendirian ulama muktabar mengenai kewajipan membantu rakyat Syria ini disahkan dan disokong oleh Resolusi Muktamar Syria di Istanbul iaitu persidangan para ulama sedunia pada 1-3 Julai 2012. Muktamar ini secara umumnya menegaskan bahawa revolusi rakyat Syria adalah kebangkitan yang hak dan benar dan adalah menjadi kewajipan semua umat Islam untuk membantu rakyat Syria dan menjatuhkan rejim Bashar al Assad. Muktamar ini merayu agar semua negara Islam di bawah pertubuhan OIC serta negara-negara lain untuk memberikan bantuan kemanusiaan termasuk membekalkan persenjataan. Informasi dan maklumat mengenai resolusi muktamar seperti ini dan bukti-bukti kezaliman rejim Bashar al Assad mungkin tidak sampai atau lambat diperolehi oleh umat Islam dan ini menyebabkan ada yang mempersoalkan tindakan rakyat Syria bangun menentang kerajaan Syria. Ini bukanlah sesuatu yang asing kerana rejim Bashar al Asad seringkali cuba untuk menyembunyikan keganasan mereka. Umpamanya telah ramai wartawan yang telah terkorban semasa membuat liputan di Syria seperti Mika Yamamoto, jurnalis Jepun yang sangat aktif melaporkan kebenaran krisis di Syria.

Misi Kemanusiaan dan Advokasi Sebagai Jihad

Fiqh jihad adalah terlalu luas untuk dibicarakan di sini. Umat Islam dinasihatkan untuk memahami fiqh jihad melalui penguasaan ilmu pengetahuan. Kerangka fiqh jihad itu perlu disesuaikan dengan fiqh waqi dan awlawiyah serta mengambil perhatian dari sudut mafsadah dan maslahah. Umumnya, jihad ini selalu difahami dengan erti mengangkat senjata sedangkan dalam konteks hari ini, bantuan kemanusiaan juga adalah jihad yang utama. Ini dinyatakan sendiri oleh ramai ulama dunia termasuk ulama tersohor Syria yang berpandangan penglibatan dari aspek kemanusiaan adalah lebih diperlukan berbanding dengan jihad mengangkat senjata. Ini juga bertepatan dengan isu pejuang-pejuang yang berjihad mengangkat senjata tanpa keizinan ibubapa dan yang mereka-mereka yang masih menuntut ilmu dan belum menamatkan pelajaran sepertimana yang diamanahkan. Sekiranya kefahaman fiqh jihad itu mendalam, sudah pasti keutamaan menunaikan amanah yang sepatutnya diaulakan diberikan perhatian.

Menelusuri pelbagai sumber bagi meneliti krisis di Syria menimbulkan persoalan yang sering dimainkan oleh ramai pihak. Keperluan jihad mengangkat senjata adalah antara perkara yang mendapat reaksi ramai. Dalam konteks ini, penulis ingin mengesyorkan selari dengan konsep fiqh awlawiyah berserta dengan nas-nas syarak dan bersesuaian dengan fiqh waqi dalam konteks semasa di Malaysia khususnya bahawasanya keperluan berjihad yang lebih aula dan utama pada waktu ini adalah dari sudut bantuan kemanusiaan dan advokasi. Fiqh Keutamaan dan Fiqh Waqi ini boleh disimpulkan sebagai disiplin ilmu yang merujuk kepada penguasan ilmu dan pemahaman dalam meletakkan sesuatu pada peringkat yang sebenar, sesuai dengan pertimbangan ilmu, keadilan, hukum syarak, akhlaq atau etika, keadaan semasa dan keadaan setempat. Ini adalah amat bersesuaian dengan ruh Islam itu sendiri di mana setiap perkara mesti diletakkan secara adil menurut syariat Islam dengan mengambil kira aspek maslahah dan mafsadah.

Dalam konteks di Syria, Mufti Wilayah Persekutuan, sohibus samahah Dr Zulkifli Muhammad Al Bakri dalam kenyataannya terkini bahkan ramai ulama tersohor dunia termasuk Syria secara jelas mengajak semua umat Islam untuk mengutamakan bantuan kemanusiaan kepada warga Syria yang kini mencecah jutaan dalam kesempitan dan kesusahan. Hingga kini dilaporkan bilangan penduduk yang menghadapi krisis kemanusiaan yang meruncing dengan ketiadaan sumber makanan, air mentah, pakaian asas, perubatan, pendidikan dan sebagainya mencecah lebih 20 juta orang. Fakta ini disahkan sendiri oleh ramai aktivis kemanusiaan seperti Malaysia Lifeline Syria yang secara langsung menyampaikan bantuan kepada rakyat Syria. Kehidupan saudara seagama seakidah yang begitu dhaif dan memilukan ini menuntut kita semua untuk mengutamakan misi kemanusiaan ini. Inilah jihad paling utama yang perlu diberikan perhatian oleh umat Islam khususnya Malaysia pada waktu ini. Jihad misi kemanusiaan juga sekaligus dapat menyelesaikan sebarang permasalahan mengenai isu kedudukan rejim al Assad mahupun status perjuangan rakyat Syria yang bangun menuntut keadilan. Jihad misi kemanusiaan ini memfokuskan kepada warga Syria yang sebenarnya perlu dibantu dengan meletakketepikan terus sebarang unsur perbezaan politik, mazhab dan ideologi.

Penutup

Adalah sesuatu yang sangat membingungkan apabila membaca dan mengetahui ada segelintir umat Islam bahkan mereka yang terpelajar menyalahkan pandangan-pandangan dan fatwa yang menyokong kebangkitan terhadap rejim yang zalim dan jelas mungkar di Syria. Bahkan golongan ini juga membuat tuduhan yang sangat dangkal mengatakan bahawa ulama yang menyokong kebangkitan rakyat ini sebagai ulama yang suka menumpahkan darah. Ironinya, golongan ini tidak pula menyalahkan rejim Asad bahkan ada yang bersama-sama Asad berdiam diri hanya melihat rakyat dibunuh dengan begitu kejam dan zalim tanpa perikemanusiaan. Golongan ini juga mula menyalahkan demokrasi dan mengatakan demokrasi tidak bersesuaian dengan dunia arab seperti di Syria. Ini sangat menakjubkan kerana golongan ini lebih rela hidup dalam sistem yang berasaskan kediktatoran dan kuku besi hinggakan ada yang mengatakan dunia arab hanya sesuai dengan sistem diktator. Ini menambahkan lagi kekeliruan dan kekaburan mengenai krisis yang begitu merugikan dunia Islam ini.

Dunia telah menyaksikan kebangkitan rakyat bermula di Tunisia diikuti Mesir, Libya, Syria dan kemungkinan negara-negara Timur Tengah yang lain. Namun, revolusi di Syria yang kini semakin meruncing menimbulkan pelbagai persoalan dan kekeliruan. Malahan persoalan yang lebih besar ialah nasib Syria pasca peperangan. Berbanding dengan kebangkitan yang berlaku di Tunisia, Mesir dan Libya, krisis di Syria adalah sedikit berlainan kerana ianya melibatkan pelbagai isu geo-politik yang lebih rumit melibatkan kuasa besar dan ketenteraan. Teori menjatuhkan rejim al Assad sebagai tindakan meningkatkan hegemoni dan penguasaan Israel di Timur Tengah juga adalah satu perkara yang tidak mempunyai asas yang kuat. Pendirian atau mauqif ulama muktabar di seluruh dunia mengenai kewajipan umat Islam untuk membantu rakyat Syria mengesahkan bahawa kebangkitan rakyat Syria adalah sesuatu yang hak dan benar. Kezaliman dan keganasan tidakperikemanusiaan tahap luarbiasa rejim Bashar al Assad adalah tindakan yang tidak boleh sama sekali diterima akal. Rejim Bashar al Assad ini mesti dibawa ke muka pengadilan dan dibicarakan di Mahkamah serta segala keganasan dan kezaliman ini didedahkan kepada dunia supaya tragedi kemanusiaan ini dapat memberi pengajaran kepada semua umat manusia.

Krisis yang berlaku di Syria menimbulkan persoalan keperluan bentuk jihad yang digagaskan oleh Islam. Dalam konteks Malaysia, kefahaman jihad yang sering kali didominasikan dengan perjuangan mengangkat senjata adalah sesuatu yang perlu disemak semula. Fiqh Jihad itu adalah terlalu luas dan tidak sepatutnya disempitkan dengan elemen peperangan dan pertumpahan darah. Dalam konteks hari ini khususnya umat Islam di Malaysia, jihad utama yang dituntut ialah membantu dengan sedaya upaya menyalurkan bantuan kemanusiaan kepada warga Syria dan advokasi kemanusiaan. Yusuf al Qaradawi dalam bukunya Fiqh Jihad telah menulis ensiklopedia jihad yang sangat komperehensif begitu juga Said Ramadhan al Buti di dalam kitabnya Al-Jihad fi al-Islam: Kaifa Tafhamuh? Wa Kaifa Numarisuh? Juga menjelaskan konsep fiqh jihad ini dengan mendalam dan penuh berhikmah. Umat Islam khususnya di Malaysia disarankan untuk mendiskusikan dan mewacanakan kedua-dua buku ini secara meluas di seluruh Negara bagi menanamkan kefahaman yang ideal dan selari dengan tuntutan syarak serta keperluan umat.

Wallahua’lam.